Quick guide — Life after registering

Life after registering under the Incorporated Societies Act 2022

Part of: Reregistration videos and tools

In this guide:

Maintaining your structure

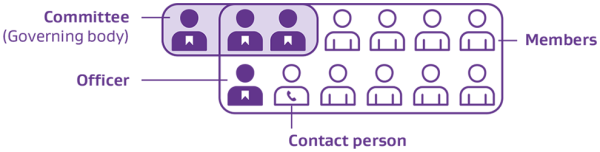

Members

- Minimum 10.

- New members must consent to be members in line with your constitution.

Committee

- Minimum 3.

- Most must be members of the society, and all are officers.

Officers

- Includes all committee members and other people with significant influence over management or administration of the society (e.g. the Treasurer or CEO).

- Must consent in writing to be an officer and certify that they are not disqualified from being an officer.

Contact person(s)

- Minimum 1, Maximum 3.

- Doesn’t need to be an officer but should be someone who can handle enquiries from the Companies Office.

Your society must decide who you want as committee members and contact persons. An example of a compliant society is set out below.

Holding Annual General Meetings (AGMs)

Timing

Must be held no later than 6 months after the balance date and 15 months after the previous AGM.

Agenda

Committee must present:

- annual report on the society's operations and affairs during the most recent accounting period

- financial statements for that period

- notice of any disclosures of conflicts of interest.

Your society may also use AGMs to vote on changes, like amending your society's constitution.

Minutes

The minutes of each AGM must be recorded and kept as part of your society's records. It is an offence for a society to fail to keep AGM minutes as part of its records.

Note that your society’s constitution must also set out when minutes of other general meetings are required to be kept.

Member requests for information

Your members may make a written request to your society for:

- The financial statements that were presented at the most recent AGM.

- The minutes of the most recent general meeting. This could be for a special general meeting as well as for an AGM.

Your society must provide this information within a reasonable period of time.

Providing information to the Companies Office

Financial statements

Timing

Must complete financial statements within 6 months of your balance date (the end of your financial year) and:

- have them dated and signed by or on behalf of the society by 2 committee members

- provide them to the Companies Office for registration (can submit this online).

Reporting requirements

Requirements vary depending on your society. If your society is:

- a ‘small society’ you only need to meet minimum requirements set out in the 2022 Act.

- not a ‘small society’ you must use External Reporting Board’s accounting standards. There are 4 reporting tiers. Your tier will depend on your total operating payments or expenses.

Auditing

An audit is only required if, in each of the 2 preceding accounting periods, the total operating expenditure of your society and all entities it controls (if any) are $3 million or more.

Annual return

Timing

Must complete an annual return each time your file your annual financial statements (can submit this online).

Return requirements

To complete your annual return you need to review, and if necessary update, key information about your society.

Changes to key information

Must update society's details if there are:

- changes to your constitution

- elections, appointments, and other changes relating to officers

- changes to your contact person, including name changes and updating their contact details

- changes to your registered office and address for communication.

Keeping society records

Register of members

Must keep a register of current and former members’ details since reregistration (to be kept for 7 years).

Interests register

Must keep a register of any disclosures officers have made regarding their conflicts of interest.

Accounting records

Must keep accounting records for the current accounting period and last 7 completed periods.

AGM minutes

Must keep copies of AGM minutes.

Other records

Other records may also need to be kept (e.g. copies of the constitution, officer documents and member consent documents). Your society can specify in its constitution what other records must be kept.

Help guides for incorporated societies

Published 1 December 2025

More 'Reregistration videos and tools' guides:

- Quick guide — Getting reregistering sorted A quick guide to getting reregistering sorted under the Incorporated Societies Act 2022

- Webinar questions and answers — 6 March 2025 The following are the questions presented to us at the recent webinar along with their answers. We have also included other common questions we have received.